TNGBL Token

Basics

Max Supply: 33,333,333

Below table is correct as of 2nd May 2022, will vary based on 3,3+ Positions being minted or early claims

Instant liquidity engine

100,000

Unlocked

0.38%

Dex Listing, future CEX listing and liquidity

69,420

Unlocked

0.27%

Pre Seed and advisors

1,255,800

4 year 3,3+ NFTs

4.81%

Team

3,097,755

4 year 3,3+ NFTs

11.87%

IDO

325,572

4 year 3,3+ NFTs

1.25%

Tangible Labs

2,499,993

4 year 3,3+ NFTs

9.58%

Bounty

54,750

4 year 3,3+ NFTs

0.21%

DAO

1,605,035

4 year 3,3+ NFTs

6.15%

Community (GURU - TNGBL swap)

16,884,935

2- 4 year 3,3+ NFTs

64.73%

Remaining to be swapped from GURU

193,802

2- 4 year 3,3+ NFTs

0.74%

What is the 3,3+ Model for the TNGBL Token?

3,3+ introduces new — and merges existing — concepts that ultimately create a new token model. It’s designed from the ground up, for our specific use case, building on both (3,3) and (ve3,3).

A multiplier that rewards you more for locking staked tokens for longer periods of time.

Native token rewards per block. One portion can be claimed immediately, while the rest can be claimed early by sacrificing future returns.

Known Max Supply: 33,333,333 tokens.

USDC rewards, 66% of marketplace revenue is distributed to holders that have locked their tokens with 3,3+ NFTs

Buy and burn, 33% of marketplace revenue is used to buy and burn the token

Early-user rewards attached to TNFTs (Tangible non-fungible tokens)

1.Multiplier

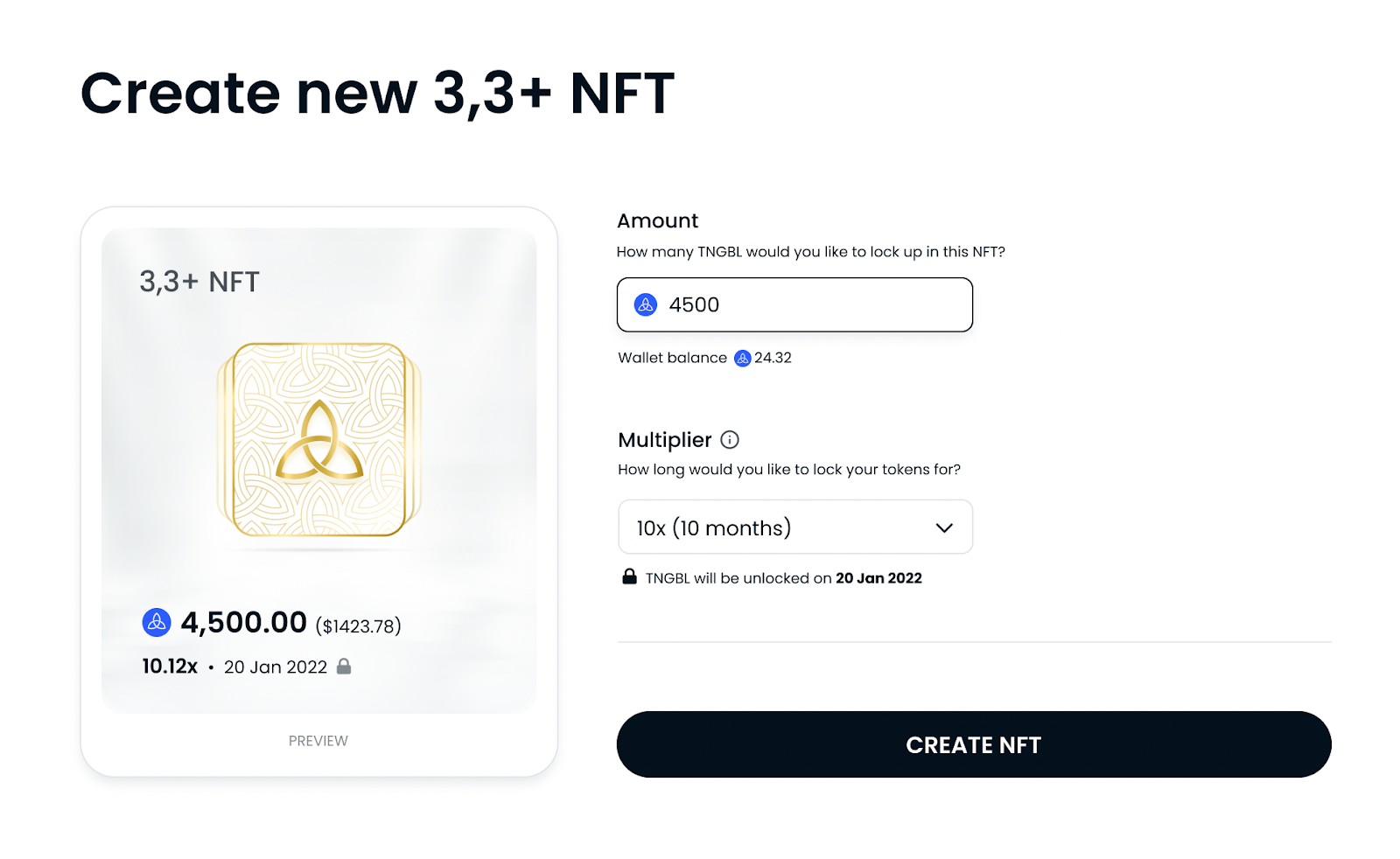

Upon launch, anyone can head to https://www.tangible.store/ and lock their TNGBL tokens for a period of up to four years. You receive a multiplier based on the length of lock you choose. When you lock your tokens, you receive a 3,3+ NFT that represents your position, and also allows you to claim TNGBL and USDC rewards.

The longer you lock your tokens, the higher your multiplier. The very highest multipliers, though, will be available immediately after launch. The early participants, who are taking on the most risk, will be rewarded the most.

Max multipliers available (48-month lock) reduce using the following schedule:

Day 1, multiplier=25.0x

Day 2, multiplier=22.5x

Day 3, multiplier=20.0x

Day 4, multiplier=17.5x

Day 5, multiplier=15.0x

Day 6, multiplier=15.0x

Then onwards:

Month 1, multiplier=14.6x

Month 2, multiplier=13.8x

Month 3, multiplier=13.1x

Month 4, multiplier=12.3x

Month 5, multiplier=11.6x

Month 6, multiplier=10.9x

Month 7, multiplier=10.3x

Month 8, multiplier=9.7x

Month 9, multiplier=9.1x

Month 10, multiplier=8.5x

Month 11, multiplier=7.9x

Month 12, multiplier=7.4x

Month 13, multiplier=6.9x

Month 14, multiplier=6.4x

Month 15, multiplier=5.9x

Month 16, multiplier=5.5x

Month 17, multiplier=5.1x

Month 18, multiplier=4.7x

Month 19, multiplier=4.3x

Month 20, multiplier=4.0x

Month 21, multiplier=3.6x

Month 22, multiplier=3.3x

Month 23, multiplier=3.0x

Month 24, multiplier=2.7x

Month 25, multiplier=2.5x

Month 26, multiplier=2.2x

Month 27, multiplier=2.0x

Month 28, multiplier=1.8x

Month 29, multiplier=1.6x

Month 30, multiplier=1.4x

Month 31, multiplier=1.2x

Month 32, multiplier=1.1x

The multipliers are only available until the total supply, which includes all future rewards from 3,3+ NFTs, has been reached. So minting new 3,3+ NFTs with a multiplier is limited to the time when the max supply of tokens has not been exceeded.

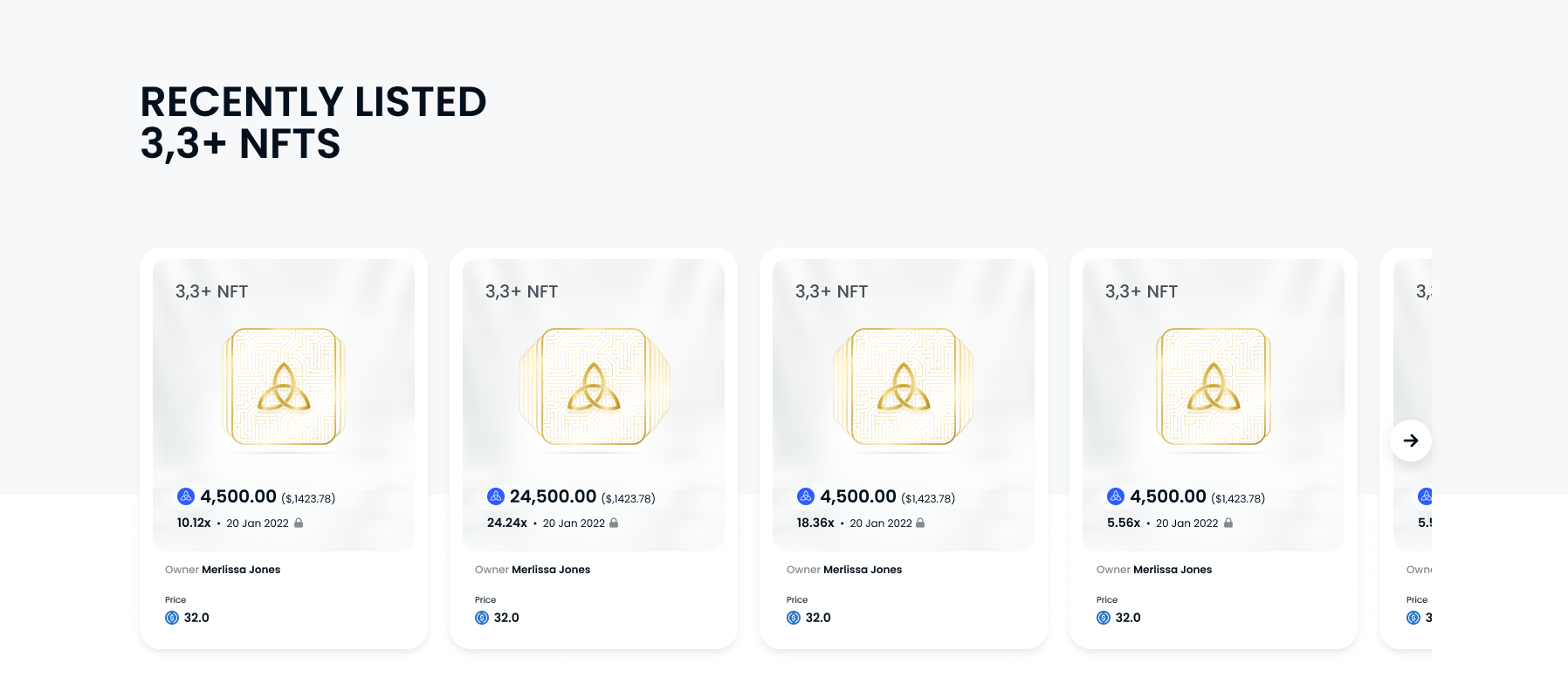

Although the initially-staked $TNGBL tokens are locked for a certain period of time, any NFT that has the TNGBL tokens attached can be sold on the TangibleDAO 3,3+ NFT marketplace.

This will create a secondary market for 3,3+ NFTs, which will allow long-term stakers to exit their position without causing any sell pressure on the underlying token.

2. Native token rewards per block

Although the initial tokens are locked until the end of the selected lock-period, a portion of the multiplier rewards are available for claiming, per block. That portion of claimable rewards will grow as the end of the lock period nears.

You can also claim a portion of the locked rewards early, in exchange for a reduction in multiplier.

3. A Known Max Supply

The max supply for the TNGBL token is 33,333,333. The 3,3+ NFTs can only be created if the token is not currently at the max supply cap. If the token is at the max supply cap, you can still lock your tokens to receive protocol revenue, but there will be no multiplier.

4. USDC rewards

All protocol fees accrue to token holders, and 66% are available to claim by 3,3+ NFT holders. The amount each 3,3+ NFT entitles you to claim is proportional to the max claimable amount in that NFT, and the total max claimable of all NFTs.

That means that if you claim some TNGBL rewards from your 3,3+ NFT, and no-one else does, then your portion of the future USDC rewards will decrease.

Locking your TNGBL tokens will allow users to lay claim to current and future potential revenues. Longer lockups result in a larger claim on future revenues due to the multiplier. Once the max supply is reached 3,3+ NFTs can still be minted with no multiplier and with a minimum lock period of 2 months to access USDC rewards.

5. Buy and Burn

33% of Tangible marketplace revenue is used to buy and burn the Tangible token.

6. Claimable Rewards aka No-Penalty Claim

This is the amount of accrued TNGBL that can be removed from the NFT at any time without impacting the multiplier. There is no penalty on the multiplier.

Claiming these rewards has the following impacts on the position:

Reduces the total end claimable amount by the number of tokens withdrawn

Reduces the revenue share percentage as only tokens held in NFTs can earn fees

Resets/temporarily flattens the accrual curve, meaning claimable tokens will accrue to the NFT more slowly for a period of time (similar to the early NFT phase) before accelerating into the curve and finishing with the correct total owed at the original maturity date

Example: 250 TNGBL is locked with a 10x multiplier. At the end of the maturity period, the owner is due 2,500 TNGBL. One year in, the owner claims 50 TNGBL in "claimable rewards." The total due is now 2,450 TNGBL at the end of the maturity period as 50 of the 2,500 have been taken out. The accrual curve adjusts to the token removal and revenue share percentage drops to reflect the removed tokens.

7. Claim Early

Claim Early removes all TNGBL accrued to the NFT and kills the multiplier.

The original locked amount will remain in the NFT until the original maturity date.

Example: The same 250 TNGBL are locked with a 10x multiplier, 2,500 due at the end of the maturity period. At some point in time, the "claim early" amount hits 500 TNGBL and the owner removes them. The multiplier on the NFT drops to 1x and the initial locked 250 tokens remain in the NFT until the end of the maturity date. No additional tokens will vest or accrue until the NFT matures to unlock the initial amount.

Some details from our quant...

Given an initial balance of X TNGBL, the locked supply grows according to the following formula:

When currentTime increases to endTime, the full amount X multiplier is accrued by the user.

Additionally, not the whole profit is available to withdraw; the amount of the profit freely available to withdraw is proportional to the squared time since the NFT was minted:

Users can withdraw in full the free amount at any time (though, as noted above, this impacts the share of Tangible’s revenue the user can earn). The user can also withdraw larger amounts, over the free amount, though never more than the total accrued profit, subject to the following limits:

The part of total profit over the free amount is called restricted profit:

Whenever the user withdraws a fraction F% of the restricted profit, the NFT’s multiplier drops by F%.

For example:

An example NFT has a multiplier of 10 and 150 TNGBL locked in

Half-way through the NFT’s lifetime, the accrued profit is 150 (10–1) (0.5)2=337.5

Of that, 84.375 is free profit, which can be withdrawn without affecting the NFT. Remaining 253.125 is restricted profit.

Suppose the user withdraws a total of 100 TNGBLs. This is over the free amount, but within the total accrued profit.

This means that 15.625 TNGBL is drawn from the restricted profit

NFT’s total multiplier drops by a factor of 15.625 / 253.125 = 6.2%, to 9.38

The evolution of total profit and free profit is illustrated on the plot below:

To determine the NFT’s multiplier, two components are considered: base multiplier and period multiplier. Base multiplier starts off at 25, dropping to 15 over the first 5 days, then decaying linearly to 5 at the end of the 4 year period. The period component is a decaying term, providing a higher premium when a longer look-up is used. The total multiplier for an NFT with lock-up time of N months is equal to

Thus, locking in on the first day for the whole period of 4 years gives the full base multiplier reward. Locking up for a shorter period gives a discount on the base multiplier. For example, locking up for 2 years instead of 4 years gives a quarter of the base multiplier available on the day. These two effects combined give the multiplier plot which can be seen above. Note that after 32 months, the multiplier drops to 1, i.e. the break even amount. This encourages earlier lock-ups, at a higher multiplier.

Last updated